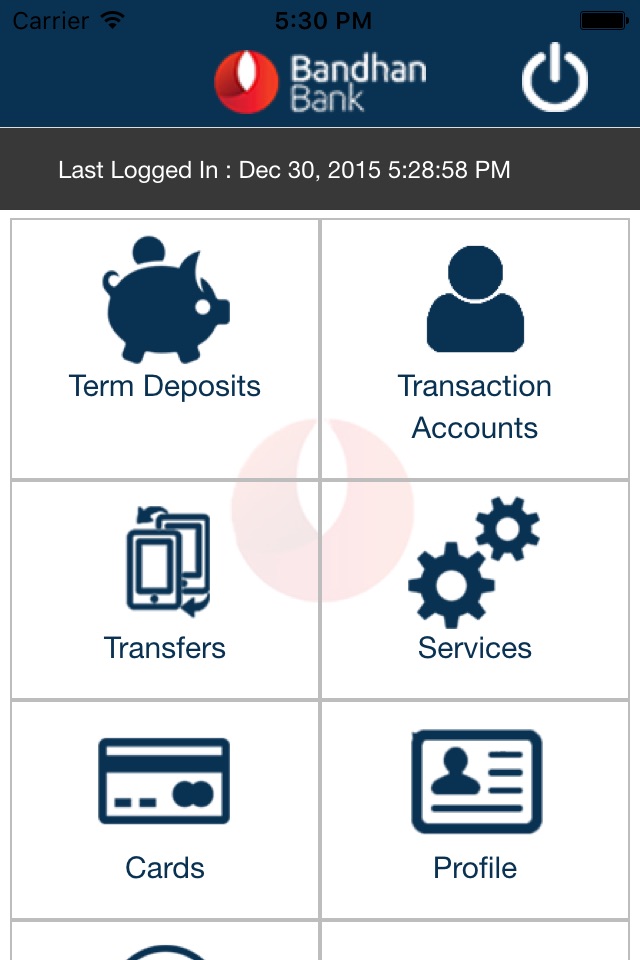

mBandhan - The Mobile Banking App

Experience the power of banking at your fingertips with the mBandhan app, a secure and user-friendly mobile banking application from Bandhan Bank Limited. With over 200 features designed to enhance your digital banking experience, the mBandhan app lets you bank anytime, anywhere, with ease and convenience.

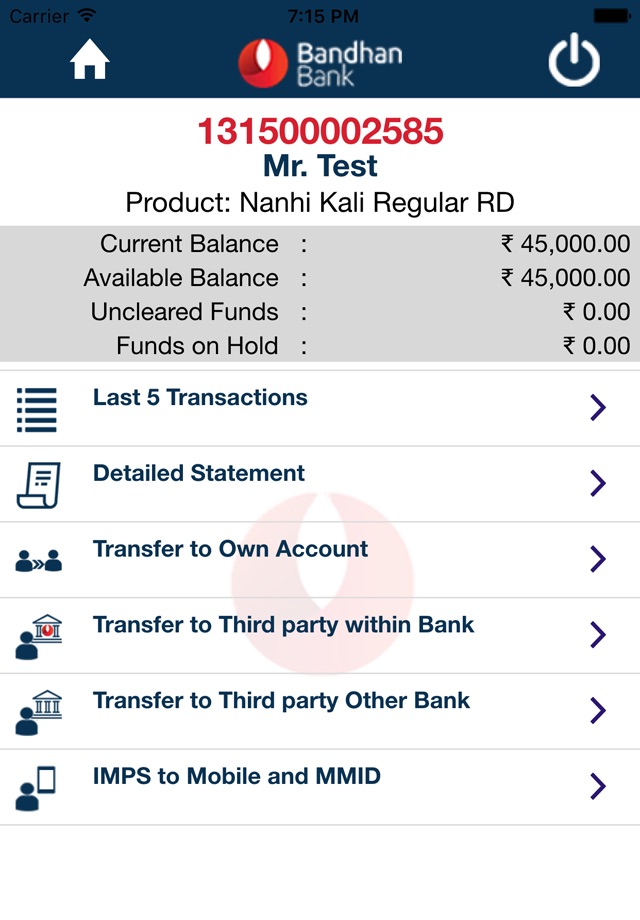

1. Access Account Information:

Stay connected to your finances with the mBandhan app. Gain instant access to your current accounts, savings accounts, cash credit accounts and loan accounts along with fixed and recurring deposits. Check your balances, review transaction history, and pre-close your deposits online, with funds instantly credited to your selected account.

2. Real-Time Funds Transfers:

Seamlessly transfer funds between your own accounts and beneficiary accounts, both within Bandhan Bank and with other banks, in real time. Enjoy the convenience of managing your funds effortlessly. Add and delete beneficiaries for Bandhan Bank and other bank transfers with just a few taps.

3. Comprehensive Services:

The mBandhan app offers a range of convenient services to simplify your banking experience. You can order a new chequebook online, update your account details such as email, PAN, and address, submit Form 15GH, view and download interest, balance, and TDS certificates, check the status of your cheques, and easily mark stop payments on your cheques. Additionally, you can view a list of your debit cards and hotlist them online if needed.

4. Enhanced Security:

Your safety and security are our top priorities. The mBandhan app ensures complete protection of your access through multiple factors of authentication. Bank with confidence, knowing that your information and transactions are secure.

Highlights of the mBandhan app:

• Simple registration and secure login options with mPIN, Touch ID, Face ID, etc.

• 360° view of accounts and transactions at a glance

• Easy booking and closing of FD and RD

• Seamless payments and fund transfer using 6-digit mPIN

• Effortless tracking and categorisation of spends

• Personalised insurance and mutual fund offerings

• Download account statements, order cheque book, track repayments, avail Form 15 G/H and other interest certificates

• Enjoy such 200 banking services from the comfort of your home

• Personalised deals and offers across categories